Oil Continues Its Downward Momentum

Market News Summary

Analysis from Markets Insider shows that Apple has spent over $500 billion on stock buybacks over the past decade, specifically since 2012. This amount exceeds the total market value of giant companies like Visa ($489 billion), JPMorgan ($446 billion), or Exxon Mobil ($441 billion).

New inflation data indicates that the Federal Reserve has likely concluded its monetary tightening cycle and interest rate hikes. It might even consider starting interest rate cuts as early as next year, according to some renowned experts.

Dollar Index (USDX)

The US Dollar index rose against a basket of six major currencies, reaching important resistance levels at 102.85. The index is still attempting to test these levels and has not yet succeeded in breaking through them.

Pivot point: 102.55

| Resistance level | Support level |

| 102.85 | 102.40 |

| 103.05 | 102.05 |

| 103.40 | 101.90 |

Spot Gold (XAUUSD)

On Friday, August 11th, gold prices held steady near their lowest point in a month, disregarding the better-than-anticipated US inflation data from the previous month. As a result, the week concluded with losses for the precious metal.

Currently, gold is trading below its pivotal mark at $1912 per ounce, undergoing a decline driven by the upward movement of the dollar and yields on Treasury bonds. These factors collectively contribute to prevailing bearish sentiment in the gold market.

Pivot point: 1915

| Support level | Resistance level |

| 1909 | 1919 |

| 1904 | 1925 |

| 1899 | 1929 |

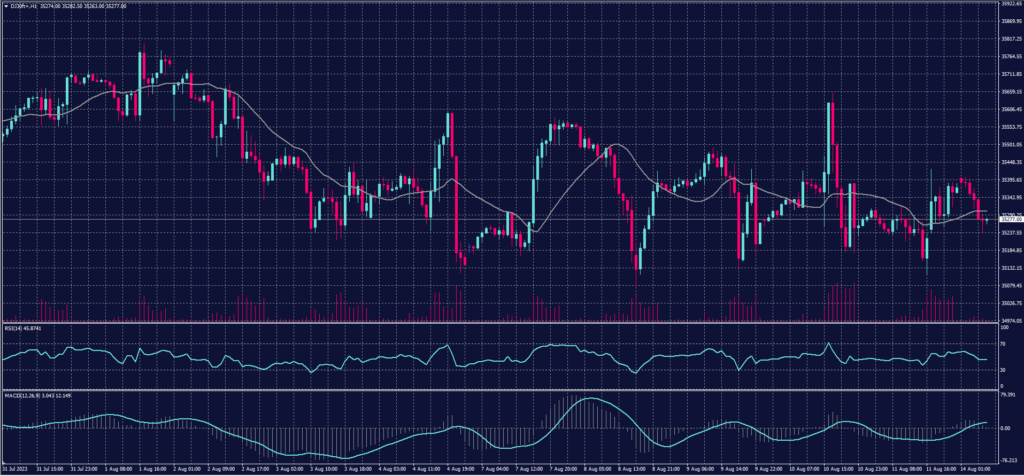

Dow Jones Index (DJ30ft – US30)

The NASDAQ and S&P 500 indices both declined at the close on Friday, marking losses for the second consecutive week. This was prompted by a higher-than-expected reading for the US Producer Price Index, which led to an increase in Treasury bond yields and a drop in shares of major technology companies.

The S&P 500 index decreased by 4.52 points, or 0.10%, to reach 4464.31 points, while the NASDAQ index lost 73.83 points, or 0.54%, ending at 13647.20 points. However, the Dow Jones Industrial Average managed to rise by 105.52 points or 0.30%, closing at 35281.67 points.

Pivot point: 35305

| Resistance level | Support level |

| 35495 | 35180 |

| 35620 | 34985 |

| 35810 | 34865 |

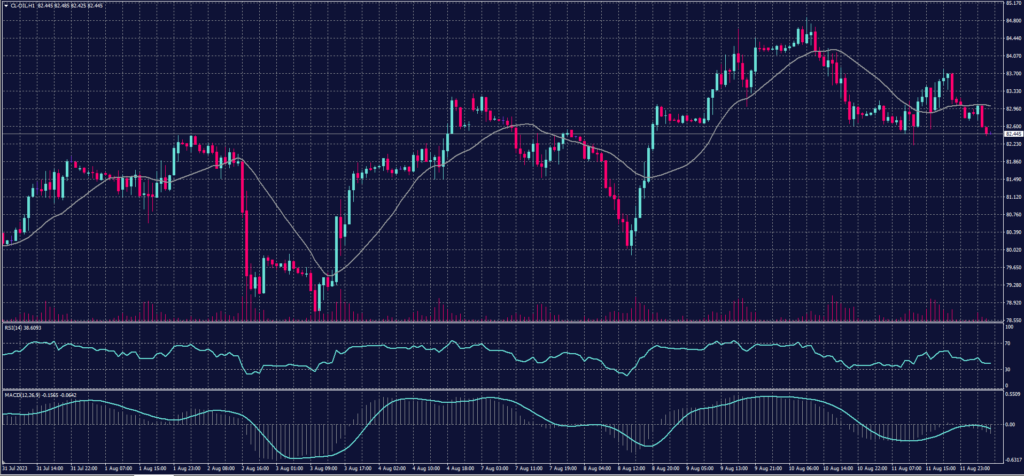

US Crude (USOUSD)

Oil prices experienced a slight decline at the beginning of this week after a seven-week streak of continuous growth, marking the longest period of gains since mid-2022.

As Asian trading commenced today, Brent crude oil retreated by 0.38 cents, or 0.44%, to $86.34 per barrel. Similarly, West Texas Intermediate (WTI) crude oil dropped by 41 cents, or 0.41%, to $82.85 per barrel at the opening.

Pivot point: 83.00

| Resistance level | Support level |

| 84.80 | 82.25 |

| 84.60 | 81.45 |

| 85.40 | 80.65 |

Risk Statement:

All investments entail risks and can result in both profits and losses. Leveraged products, in particular, may not be appropriate for all investors as the effect of leverage is that both gains and losses are magnified. Before deciding to invest in any financial product, you should carefully consider your investment objectives, financial knowledge and experience and affordability as the prices of leveraged products may change to your disadvantage very quickly, it is possible for you to lose more than your invested capital and you may be required to make further payments.