31 May 2022 – Crude Oil At Two Months High

market news summary

U.S. Dollar slows the fall;

Treasury yields advance;

Investors are seeking safety;

Crude oil prices rocketing.

U.S. Dollar Index (USDX)

The U.S. Dollar traded up during the early trades this morning as investors are avoiding riskier investments. The Federal Reserve is set to start shrinking its $8.9 trillion balance sheet and release its Beige Book, on Wednesday. U.S. President Joe Biden will also hold a meeting with Fed Chairman Jerome Powell later in the day. The U.S. jobs report, including non-farm payrolls, is also due on Friday.

Technically:

The U.S. Dollar index goes higher today breaking out of the downward channel and trading at 101.60. Additionally, the index trades at the 20 periods SMA and above the 55 periods SMA but remains to indicate a further decline.

Likewise, the index is cementing its declining pattern on the hourly chart which targets 101.20 on the hourly chart. Technical indicators show a likelihood of further decline.

PIVOT POINT: 101.60

| SUPPORT | RESISTANCE |

| 101.20 | 101.90 |

| 101.00 | 102.60 |

| 100.70 | 103.10 |

Euro (EURUSD)

The euro retreated this morning but held the record for the best performing month this year. Additionally, the increase in interest rate anticipations in Europe and economic slow in the U.S. supported the common currency.

The German inflation rose to its highest level in nearly 50 years in May amid soaring energy and food prices. Meanwhile, market participants expect the European Central Bank to raise rates in July for the first time since the pandemic began.

Technically:

The European currency lost around 0.3% from one month high to hover around 1.0745, having hit a five-week high of 1.0786 overnight. Moreover, the euro is set for a 2.2% gain in May, which would be its biggest monthly rise in a year.

However, Fibonacci retracement shows slight support at 1.0720 while technical indicators show a possibility to reach 1.0700. Though, the 20 periods moving average on the daily chart remains above the price level while the 55 SMA is below, which indicate a further decline.

PIVOT POINT: 1.0710

| SUPPORT | RESISTANCE |

| 1.0610 | 1.0740 |

| 1.0550 | 1.0840 |

| 1.0510 | 1.0910 |

Sterling Pounds (GBPUSD)

Market participants worry about the efficiency of BOE’s plan to face inflation increases, while numbers show that whatever BOE is doing is not enough. The BOE has faced political attacks over its response to inflation, which is at its fastest rate in four decades. Despite four interest-rate increases since December and money markets bracing for more in each of its next five decisions, the pound is the third-worst performing major currency this year.

Technically:

The sterling pound fell from the resistance level of 1.2650 to touch the lower band of the Bollinger bands and trade below the 55 SMA on the hourly chart. However, the cable retains its uptrend on the daily chart and remains near the daily resistance of 1.2610.

PIVOT POINT: 1.2620

| SUPPORT | RESISTANCE |

| 1.2500 | 1.2695 |

| 1.2440 | 1.2750 |

| 1.2350 | 1.2790 |

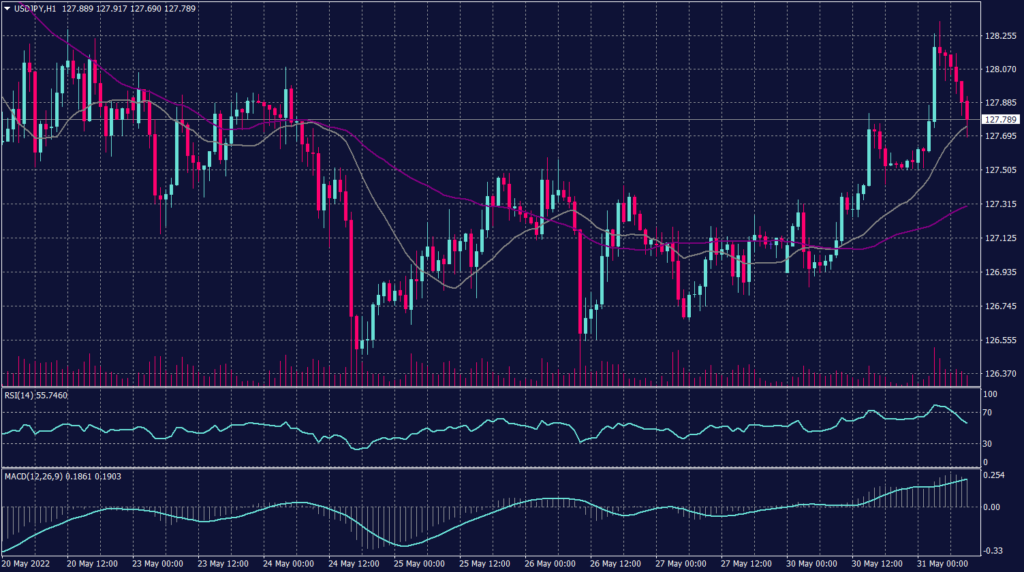

Japanese Yen (USDJPY)

Japan’s unemployment rate fell to 2.5% in April, while the availability of jobs increased as the government data showed. The seasonally adjusted unemployment rate was lower than the 2.6% reported for March, which was also the median forecast for April.

Technically:

The Japanese Yen gains ground against the U.S. dollar this morning heading towards 127.50 on the hourly chart. However, the daily chart shows that the pair is slowing the fall as the U.S. dollar buying activities provide support but keeps the target at 126.24.

PIVOT POINT: 127.50

| SUPPORT | RESISTANCE |

| 127.00 | 127.90 |

| 126.30 | 128.00 |

| 125.90 | 128.40 |

Spot Gold (XAUUSD)

Gold was down rising U.S. Treasury yields impacted demand for the yellow metal. Furthermore, gold is set for a second consecutive monthly loss for the first time since March 2021. Benchmark U.S. 10-year Treasury yields climbed on Tuesday, with bond markets in the U.S. closed during the previous session for a holiday.

Gold futures edged up 0.17% to $1,854.20 and are down about 2.6% in the month to date, the most since September 2021. Similarly, other precious metals also declined this morning, silver fell 0.7%, platinum fell 0.8%, and palladium eased 0.2%.

Technically:

On the hourly chart, the precious metals trade in a mixed fashion but keep the support above 1,850. However, spot gold is moving upwards from the support at $1,850 per ounce and is expected to remain unless it broke below 1,842. Technical indicators show a possibility of a decline, as RSI is showing the gold is overbought, while MACD is neutral.

PIVOT POINT: 1,860

| SUPPORT | RESISTANCE |

| 1,850 | 1,875 |

| 1,810 | 1,895 |

| 1,800 | 1,905 |

West Texas Crude (USOUSD)

Crude oil grew further gains on Tuesday after the EU agreed to cut oil imports from Russia, fuelling worries of a tighter market already strained for supply amid rising demand ahead of peak U.S. and European summer driving season.

Brent crude for July, which expires on Tuesday, rose $1.13 to a fresh two-month top of $122.80 a barrel. Meanwhile, West Texas Intermediate (WTI) futures traded at $118.25 a barrel.

Technically:

WTI broke the resistance at 115 reaching its two months high at 118.25 during the early trades. However, according to the Bollinger bands, WTI is set to a correction after touching the upper band and it may run back towards the 55 periods moving average.

Fibonacci retracement shows firm support at 112.75 and the 55 SMA reads a further advancement. RSI is showing WTI is overbought, while MACD shows a continuation.

PIVOT POINT: 117.50

| SUPPORT | RESISTANCE |

| 117.00 | 119.00 |

| 105.75 | 122.80 |

| 104.30 | 125.00 |