Bitcoin Fluctuates as Binance SEC lawsuit Rattles Investors

market news summary

European stock indices rose at the end of yesterday’s session on June 6, amid investors’ lack of sufficient information about the future monetary policy path of central banks. At the end of the session, the STOXX600 index rose by about 0.38% to 461 points, the German DAX increased by 0.18% to 15,992 points, the British FTSE gained about 0.37% at 7,628 points, and the French CAC rose by 0.1% to 7,209 points.

The U.S. Securities and Exchange Commission (SEC) has filed an emergency motion in a federal court in Washington, D.C. to freeze the assets of Binance US and recover the assets (fiat and cryptocurrency) held by customers on the Binance US trading platform. The request for freezing applies to the two holding companies affiliated with Binance in America, not the unregulated international exchange in America.

Dollar Index (USDX)

The US dollar continued its decline from a two-and-a-half-month high it reached last week against major currencies, following unexpectedly weak data on the US services sector released yesterday evening. The data strengthened expectations that the Federal Reserve would not raise interest rates at its meeting next week. However, this casts a shadow over expectations for monetary policy in the coming months.

Pivot point: 104.05

| Resistance level | Support level |

| 104.35 | 103.72 |

| 104.60 | 103.45 |

| 104.90 | 103.20 |

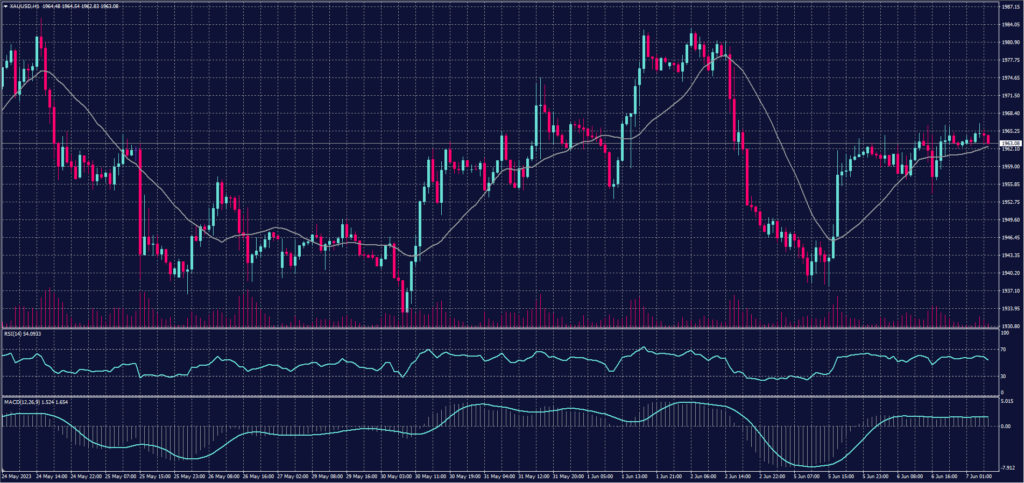

Spot Gold (XAUUSD)

Gold futures rose for a second consecutive session at the end of yesterday’s session, as market participants continued to monitor expectations regarding the Federal Reserve’s monetary policy. Additionally, a report by the World Bank on the global economic outlook was released, which projected global GDP growth to be around 2.1% in 2023, a lower level than the 3.1% recorded in 2022.

At the end of the session, gold futures increased by approximately $7.2 or 0.4% to $1981.5 per ounce.

Pivot point: 1961

| Resistance level | Support level |

| 1968 | 1956 |

| 1973 | 1949 |

| 1980 | 1944 |

Dow Jones Index (DJ30ft – US30)

US stock indices closed with collective gains in yesterday’s Tuesday session, as investors awaited inflation data and the upcoming decision from the US Federal Reserve.

It is expected that inflation data will show a slight decrease in consumer prices on a monthly basis in May, but core prices are likely to remain elevated. It is widely expected that the Federal Reserve will maintain interest rates.

The Dow Jones Industrial Average closed higher by about 10 points on Tuesday after recovering all its losses by the end of the session, having briefly touched the 50-day moving average levels in the early hours of the session.

Pivot point: 33575

| Resistance level | Support level |

| 33710 | 33480 |

| 33805 | 33345 |

| 33935 | 33250 |

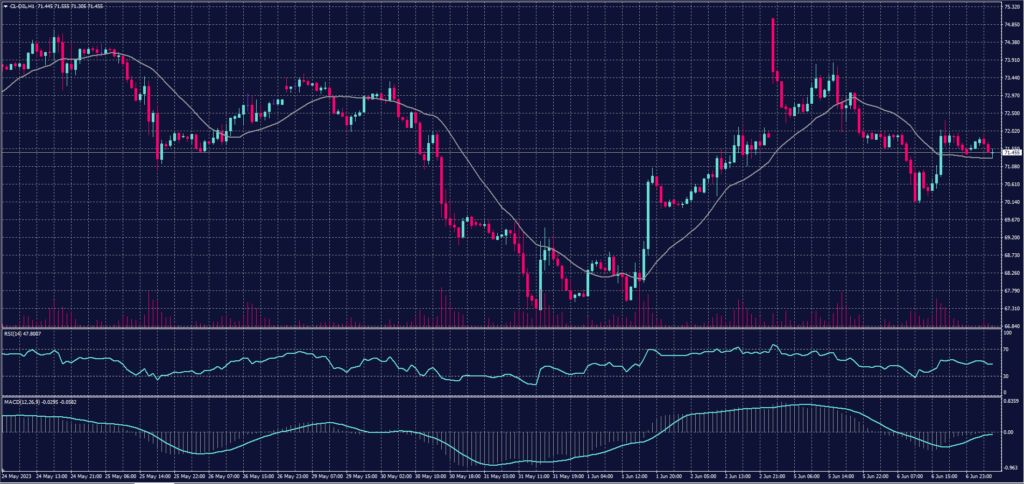

US Crude (USOUSD)

Oil prices ended Tuesday’s session on a decline amid concerns about slowing global economic growth.

At the close, Brent crude futures fell by about 0.6% to $76.29 per barrel, while US oil futures dropped by 0.6% to $71.74 per barrel.

Pivot point: 71.25

| Support level | Resistance level |

| 70.25 | 72.45 |

| 69.10 | 73.40 |

| 68.05 | 74.65 |

Risk Warning

This material provides real-time market analysis from contributing analysts. Please note that any views expressed in this material do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this material.