Bitcoin Jumps Above $28,000

market news summary

Bitcoin, the largest cryptocurrency by market capitalization, surged during yesterday’s trading session on Tuesday, June 20th, to its highest level this month, surpassing the $28,000 mark.

The gains came after BlackRock, the world’s largest asset management company, filed for a spot bitcoin exchange-traded fund (ETF), which would be the first of its kind in the United States. Cryptocurrencies also received a boost over the weekend as Binance reached an agreement that prevented the freezing of its assets in the United States.

European indices declined at the end of Tuesday’s trading session, as investors remain concerned about the outlook for the global economy, particularly after the release of the latest Chinese data.

At the session’s close, the STOXX600 index dropped by approximately 0.59% to 459 points, while the German DAX fell by 0.55% to reach 16,111 points. The FTSE British index ended the session down 0.25% at 7,569 points, and the French CAC declined by 0.27% to 7,294 points.

Dollar index (USDX)

Economic data revealed that new home construction in the United States surged by approximately 21.7% in May to reach 1.63 million on an annual basis, as reported last month. Housing data indicates that the economy remains in a favorable position, and it is likely that the Federal Reserve will raise interest rates again in July.

Pivot point: 102.10

| Resistance level | Support level |

| 102.35 | 101.85 |

| 102.55 | 101.65 |

| 102.75 | 101.45 |

Spot Gold (XAUUSD)

Gold prices declined in yesterday’s Tuesday, June 20th, trading session due to the strength of the dollar following the release of economic data.

At the close, gold futures dropped by approximately 1.2% or $23.5 to $1947.7 per ounce.

Pivot point: 1940

| Resistance level | Support level |

| 1952 | 1924 |

| 1967 | 1913 |

| 1979 | 1897 |

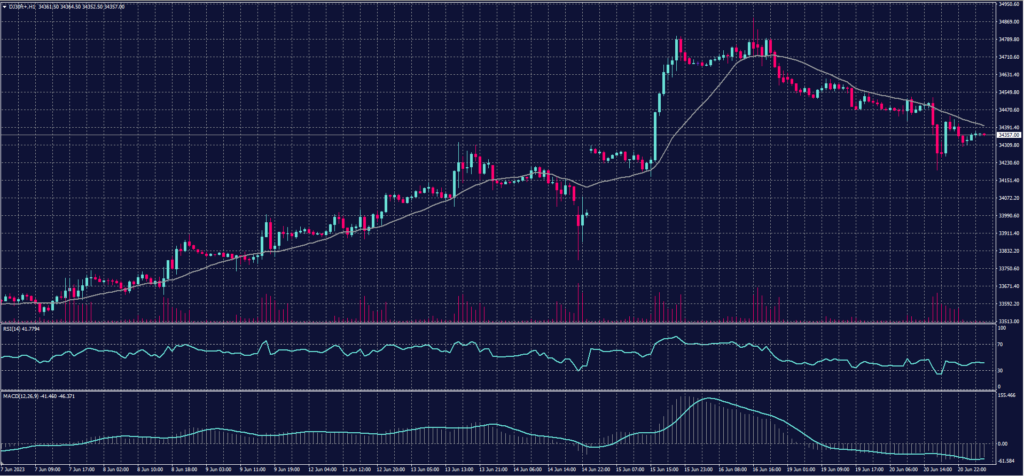

Dow Jones Index (DJ30ft – US30)

US indices closed with collective declines, weighed down by profit-taking after strong gains last week and ahead of the testimony of the Federal Reserve Chairman before Congress today, Wednesday.

The widespread selling comes after the longest winning streak for the Nasdaq since March 2019 and the longest for the S&P 500 since November 2021.

The Dow Jones index fell by approximately 0.72%, equivalent to around 245 points, marking its biggest daily loss in 3 weeks.

Pivot point: 34355

| Resistance level | Support level |

| 34515 | 34165 |

| 34705 | 34005 |

| 34865 | 33815 |

US Crude (USOUSD)

Oil prices declined at the close of yesterday’s Tuesday, June 20th, trading session amid uncertainty about the performance of the global economy and following a Chinese decision regarding lending interest rates.

China reduced its key lending rates for the first time in ten months, but by a smaller margin than expected, cutting the 5-year benchmark lending rate by 10 basis points.

At the close, Brent crude futures dropped by approximately 0.3% to $75.9 per barrel, while WTI crude futures fell by 1.8%, reaching $70.5 per barrel.

Pivot point: 71.00

| Resistance level | Support level |

| 72.20 | 69.60 |

| 73.55 | 68.40 |

| 74.80 | 67.00 |

Risk Warning

This material provides real-time market analysis from contributing analysts. Please note that any views expressed in this material do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this material.