Fed maintains rates and communicates objectives clearly

Market News Summary

Jerome Powell, the Federal Reserve Chairman, stated that achieving the targeted inflation of 2% will take a long time, and the full impact of monetary tightening on the US economy will be evident later.

Despite the ongoing upward pressures of inflation, the Fed is making progress in combating it. Powell also indicated that most monetary policymakers at the Federal Reserve see it appropriate to increase interest rates this year and reaffirmed their commitment to achieving the 2% inflation target. It is worth mentioning that the Federal Reserve Board decided to keep the interest rate unchanged at 5.00%-5.25%, following ten previous interest rate hikes.

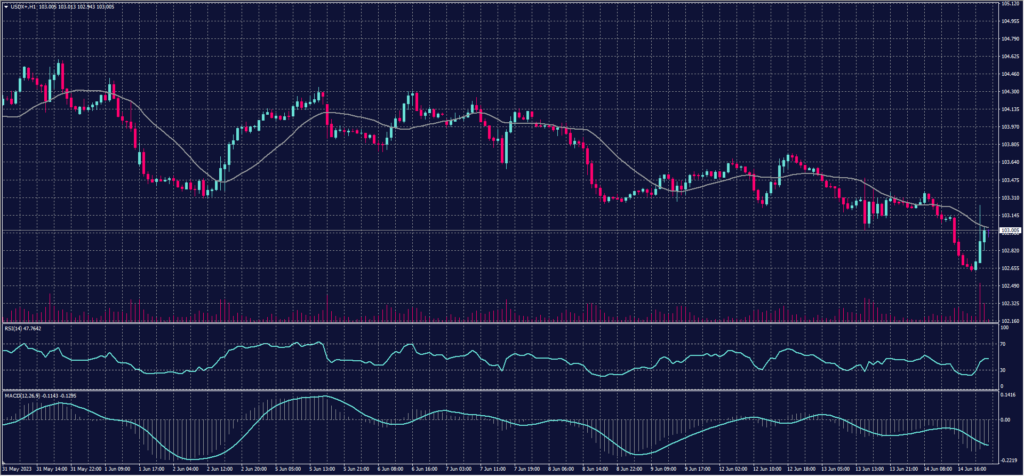

Dollar Index (USDX)

The US dollar declined following the Federal Reserve’s decision to keep interest rates unchanged, but it signaled an increase in borrowing costs later in the year.

The dollar index fell by 0.15% to 103.19, reaching its lowest level in 4 weeks. The Fed projected interest rate hikes to reach 4.6% in 2024 and 3.4% in 2025, surpassing previous expectations set in the March meeting.

Furthermore, the Federal Reserve raised its economic growth forecast for the current year to 1% compared to previous estimates in the March meeting.

Pivot point: 102.99

| Support level | Resistance level |

| 102.65 | 103.15 |

| 102.35 | 103.35 |

| 102.15 | 103.65 |

Spot Gold (XAUUSD)

Early gains in spot gold contracts were trimmed, with only a 0.12% increase, trading at $1,942.86 per ounce, while August futures contracts settled at $1,958 per ounce.

This came as the rise in the dollar increased the opportunity cost of holding bullion.

Pivot point: 1947

| Support level | Resistance level |

| 1934 | 1955 |

| 1926 | 1967 |

| 1913 | 1975 |

Dow Jones Index (DJ30ft – US30)

US indices closed with mixed results amid sharp volatility during yesterday’s Wednesday session after the Federal Reserve kept interest rates unchanged as expected. However, in new economic projections, they indicated that borrowing costs are likely to increase by another half a percentage point by the end of this year.

The Dow Jones Industrial Average declined by approximately 0.7%, equivalent to around 232 points, in yesterday’s session following six consecutive sessions of gains. The largest pressure came from UnitedHealth stock, which fell by over 6%.

Pivot point: 34005

| Support level | Resistance level |

| 33785 | 34215 |

| 33575 | 34430 |

| 33365 | 34645 |

US Crude (USOUSD)

Oil prices fell by 1.5% yesterday, Wednesday, after the US Federal Reserve projected further interest rate increases this year, raising concerns in the markets about demand. This came just hours after government data showed a significant and unexpected increase in US crude oil inventories.

Brent crude futures closed down $1.09, or 1.5%, at $73.20 per barrel, while US West Texas Intermediate crude dropped $1.15, or 1.7%, to $68.27 at settlement.

Pivot point: 69.05

| Support level | Resistance level |

| 67.65 | 70.05 |

| 66.65 | 71.45 |

| 65.30 | 72.45 |

Risk Warning:

The effect of leverage is that both gains and losses are magnified, it is possible for you to lose more than your capital. It is important that you understand that your capital is at risk with investments.