Gold Begins Its Downward Trend

market news summary

The Bitcoin cryptocurrency recorded significant gains last week, rising by approximately 17% in its best weekly performance since March 17th.

During their meeting on Friday, Amazon CEO Andy Jassy informed Indian Prime Minister Narendra Modi that the company plans to invest an additional $15 billion in India.

European stocks declined on Friday, concluding a week filled with central bank decisions on monetary policies that reinforced the views suggesting the possibility of higher interest rates for a longer period. Siemens Energy shares plummeted after the company withdrew its annual profit forecasts. The STOXX 600 European index closed down by 0.3% as data revealed a slowdown in business activity in the Eurozone this month, particularly in the manufacturing sector.

Dollar Index (USDX)

The dollar received support from a wave of risk aversion last Friday, as statements endorsing monetary tightening from global central banks, including the US Federal Reserve, raised concerns about a larger economic contraction.

However, the dollar index did not sustain its levels around 102.75 and declined today, reaching levels around 102.35 below its pivot point.

Pivot point: 102.40

| Resistance level | Support level |

| 102.85 | 102.05 |

| 103.20 | 101.60 |

| 103.65 | 101.25 |

Spot Gold (XAUUSD)

Gold prices recorded their largest weekly percentage decline in over four months, influenced by the rise of the dollar and the hawkish stance on interest rate hikes by Federal Reserve officials.

Spot gold contracts rose by 0.3% to $1,918.79 per ounce after a 1.2% increase due to the decline in US bond yields. However, they closed the week with a 2.1% loss. Meanwhile, US gold futures increased by 0.3% to $1,928.90 per ounce.

Pivot point: 1922

| Resistance level | Support level |

| 1935 | 1908 |

| 1949 | 1895 |

| 1962 | 1880 |

Dow Jones Index (DJ30ft – US30)

US stocks closed lower at the end of last week, which was dominated by Federal Reserve Chairman Jerome Powell’s testimony. In his testimony, Powell hinted at the possibility of interest rate hikes but reassured that the Fed would exercise caution.

The three major market indices declined in a widespread selling wave, with the Nasdaq Composite index being impacted by the drop in stocks of interest rate-sensitive companies. The Dow Jones Industrial Average decreased by 217.07 points or 0.64% to 33,729.64 points.

Pivot point: 34035

| Resistance level | Support level |

| 34185 | 33825 |

| 34395 | 33675 |

| 34545 | 33465 |

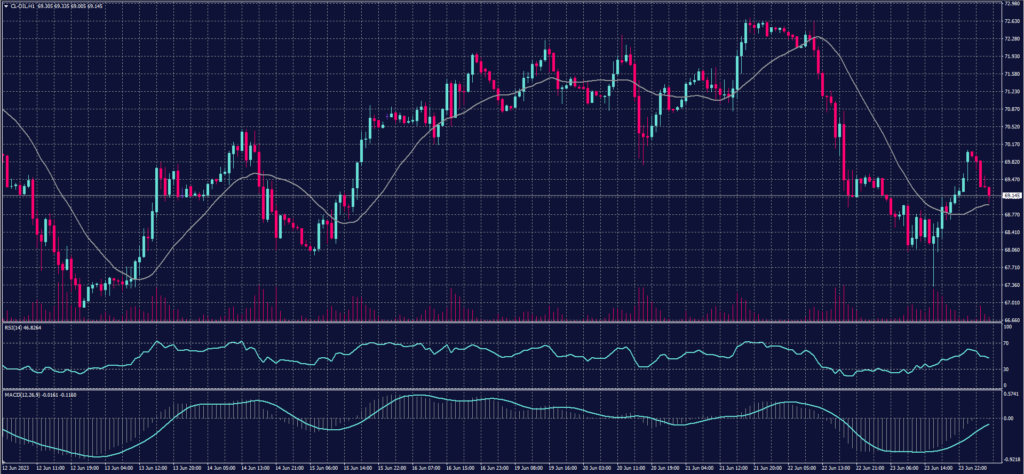

US Crude (USOUSD)

Oil prices declined at the Friday close, registering a weekly loss amid investor concerns over the potential impact of interest rate hikes on oil demand, despite signs of declining supply, including a decrease in US crude inventories.

Brent crude fell by 29 cents or 0.4% to $73.85 per barrel at the close, marking a second consecutive day of losses. Meanwhile, West Texas Intermediate (WTI) crude dropped by 35 cents or 0.5% to $69.16 per barrel.

Pivot point: 68.80

| Resistance level | Support level |

| 70.30 | 68.00 |

| 71.05 | 66.55 |

| 72.55 | 65.75 |

Risk Warning

This material provides real-time market analysis from contributing analysts. Please note that any views expressed in this material do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this material.