Gold Declines and Dollar Stabilizes

Market News Summary

European stocks closed on Friday at their highest levels in three weeks, driven by increases in luxury goods and defense stocks at the end of a week dominated by decisions from major central banks.

The European Stoxx 600 index rose 0.5% on Friday. For the entire previous week, the index gained 1.5%, marking its best weekly performance in over two months.

The pricing of shares of 24 Chinese companies listed on the Hong Kong Stock Exchange in the Chinese yuan begins today, Monday, June 19, giving the Chinese currency an additional boost in the global financial world. Both Alibaba and Tencent are expected to be among the stocks traded in both the yuan and the Hong Kong dollar, which is pegged to the US dollar.

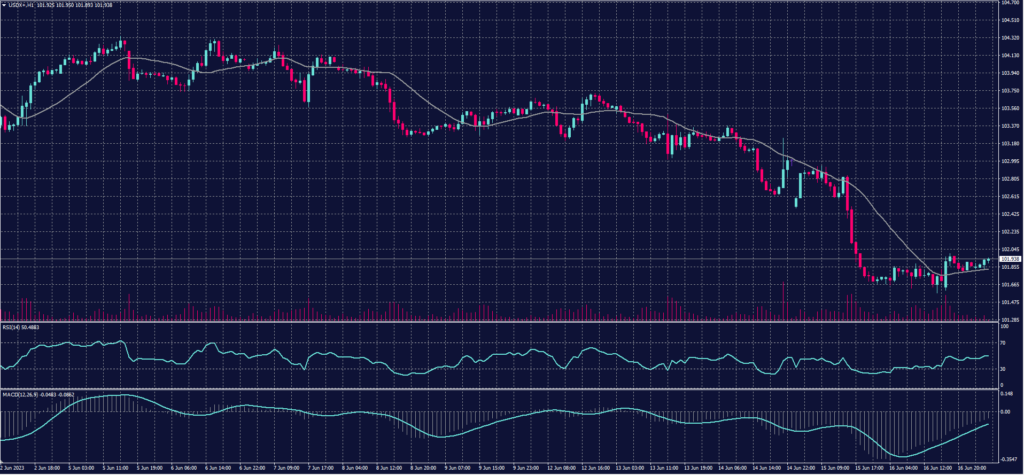

Dollar index (USDX)

After the US Federal Reserve indicated on Wednesday that interest rates may still need to rise by up to half a percentage point by the end of the year, traders expect a 25-basis-point interest rate hike in July.

The dollar index rose but remained near its lowest level in a month.

Pivot point: 101.80

| Resistance level | Support level |

| 102.05 | 101.60 |

| 102.25 | 101.40 |

| 102.45 | 101.20 |

Spot Gold (XAUUSD)

Gold declined on Friday, June 16, as the dollar hovered near its lowest level in a month, under pressure from expectations of US interest rate increases this year.

Spot gold dropped 0.17% to $1,954.40 per ounce and ended the week with a decline of 0.32%.

Pivot point: 1959

| Resistance level | Support level |

| 1965 | 1950 |

| 1974 | 1944 |

| 1980 | 1936 |

Dow Jones Index (DJ30ft – US30)

The Standard & Poor’s 500 index closed lower on Friday, with Microsoft stock declining, as statements from two Federal Reserve officials dampened optimism about the central bank nearing the end of its aggressive campaign to raise interest rates.

The S&P 500 index dropped 0.36% to close at 4,409.84 points, while the Nasdaq index fell 0.68% to 13,689.57 points. The Dow Jones Industrial Average also declined by 0.31% to 34,301.36 points.

Pivot point: 34685

| Resistance level | Support level |

| 34790 | 34490 |

| 34990 | 34385 |

| 35095 | 34185 |

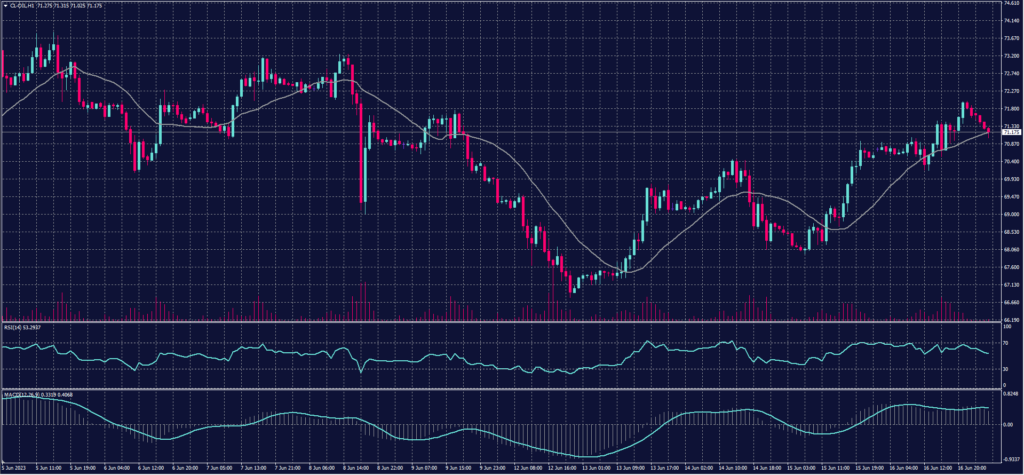

US Crude (USOUSD)

Russian President Vladimir Putin said today, Friday, that the oil production cuts made by the OPEC+ alliance are “unrelated” and have no connection to what Moscow calls its “special military operation” in Ukraine.

Brent crude futures fell to $75.50 per barrel, while West Texas Intermediate (WTI) crude oil increased to $71.00 per barrel.

Pivot point: 71.25

| Resistance level | Support level |

| 72.35 | 70.50 |

| 73.10 | 69.45 |

| 74.20 | 68.65 |

Risk Warning:

The effect of leverage is that both gains and losses are magnified, it is possible for you to lose more than your capital. It is important that you understand that your capital is at risk with investments.