Oil Prices Decline to Their Lowest Levels in Months Amid Concerns About Inflation

Market News Summary

European stock indices fell at the end of Tuesday’s trading session as investors absorbed the latest inflation reading in the United States and awaited the start of the Federal Reserve’s policy meeting. The Stoxx 600 European index closed down by 0.23%, with losses in the oil and gas sector by 1.28%.

The U.S. Consumer Price Index rose by 0.1% in November and 3.1% on an annual basis. Economists had expected no monthly increase and had anticipated a 3.1% reading on an annual basis. These data come as the Federal Reserve begins its two-day meeting, during which it will discuss the latest interest rate policy and release economic forecasts.

Dollar Index (USDX)

The Consumer Price Index in the United States rose by 3.1% on an annual basis for the month of November. The increase was driven by rising rents, overshadowing the decline in gasoline prices. Following the release of inflation data, bets on a rate cut for March next year decreased from 50% to around 44%, while bets for May increased from 75% to 78%.

The dollar index is currently trading above its pivot point at $103.85.

Pivot Point: 103.75

| Resistance level | Support level |

| 104.10 | 103.45 |

| 104.40 | 103.10 |

| 104.70 | 102.80 |

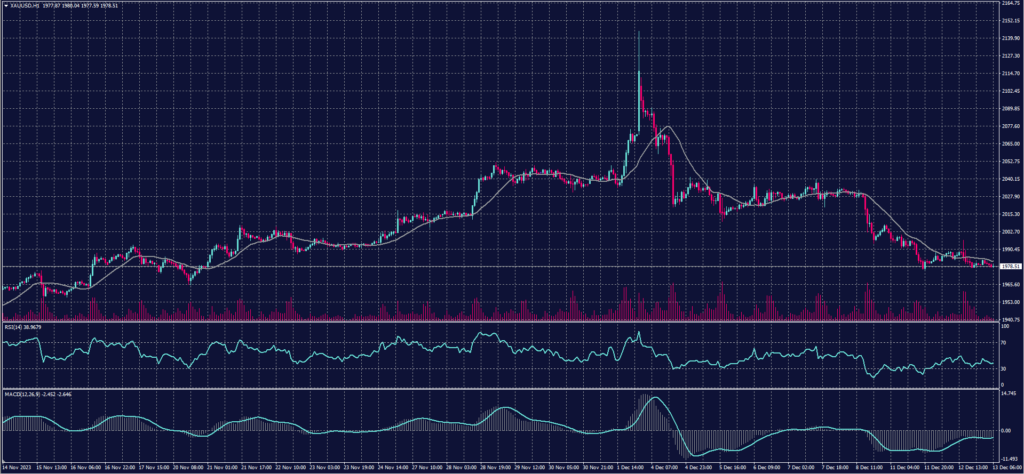

Spot Gold (XAUUSD)

Gold prices declined on Wednesday, December 13th, amid the rise of the dollar and U.S. bond yields, as investors awaited the Federal Reserve’s meeting.

Gold fell in spot trading, reaching $1,977 per ounce.

Pivot Point: 1984

| Resistance level | Support level |

| 1991 | 1972 |

| 2003 | 1964 |

| 2011 | 1952 |

Dow Jones Index (DJ30ft – US30)

The U.S. indices closed with collective gains on Tuesday after inflation data aligned with expectations, amid anticipation of the Federal Reserve’s final decision of the year on interest rates.

The Dow Jones index rose by about 0.48%, equivalent to 173 points on Tuesday’s session, marking its fourth consecutive daily gain. The S&P 500 index also increased by 0.46%, recording its highest close in 23 months, despite a 1% decline in the energy sector index due to a sharp drop in oil prices.

Meanwhile, the technology sector was among the best-performing sectors, reaching a record level poised to achieve the largest annual percentage gains since 2019. The Nasdaq index rose by 0.7%, equivalent to approximately 100 points.

Pivot Point: 36910

| Resistance level | Support level |

| 37065 | 36830 |

| 37150 | 36675 |

| 37305 | 36590 |

US Crude Oil (USOUSD)

Oil prices fell on Tuesday, December 12th, to their lowest levels in six months, by about 4%, amid concerns about inflation and worries related to supply surpluses.

Analysts and traders considered that the duration of the oil production cuts by OPEC+ of 2.2 million barrels per day in the first quarter of 2024 may not be long enough, as both actual oil prices and futures contracts show increasing signs of a surplus before the scheduled implementation date.

Futures contracts for U.S. crude recorded a decline of 3.80% to settle at $68.61 per barrel, while Brent crude futures also fell by 3.67% to settle at $73.24 per barrel.

Pivot Point: 69.65

| Resistance level | Support level |

| 71.05 | 67.30 |

| 73.35 | 65.90 |

| 74.80 | 63.55 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.