Oracle Stocks Gained $8B in a Single Day

market news summary

European stocks closed lower on Tuesday due to weak data from the services sector in China and the Eurozone, fueling concerns about global economic slowdown. However, gains in energy company stocks helped limit the losses.

The European Stoxx 600 index closed down 0.2%, extending its losses for the fifth consecutive session. Business activity in the Eurozone declined faster than expected in August as the services sector entered a contraction phase.

In Wall Street, Airbnb’s stock rose by 7.2% on Tuesday, marking its biggest daily gain in six months. The company added more than 6 billion dollars to its market value in a single day.

Dollar Index (USDX)

On Tuesday, Federal Reserve Chair Christopher Wall stated that the most recent economic data would afford the central bank some breathing room to determine whether further interest rate hikes are necessary to combat inflation. Following these remarks, the value of the US dollar appreciated.

The dollar is currently trading above its pivotal point at $104.65.

Pivot point: 104.55

| Resistance level | Support level |

| 105.05 | 104.25 |

| 105.35 | 103.75 |

| 105.85 | 103.45 |

Spot Gold (XAUUSD)

Gold prices rebounded from their losses yesterday, Tuesday, following significant statements from the US Federal Reserve, alongside the rise of the US dollar index and US Treasury bond yields.

Gold futures declined by 0.77% to $1,952 per ounce, while spot gold contracts fell by 0.61% to $1,926 per ounce.

Pivot point: 1929

| Resistance level | Support level |

| 1934 | 1921 |

| 1943 | 1916 |

| 1948 | 1907 |

Dow Jones Index (DJ30ft – US30)

On Tuesday, US stock indices experienced overall declines, driven by mounting Treasury bond yields and surging oil prices. Investors were carefully evaluating the potential shifts in interest rate dynamics. The increase in US Treasury bond yields was prompted by robust economic data, which underscored resilience in the economy. Additionally, a Federal Reserve official remarked that this data implies the central bank is unlikely to make imminent changes to interest rates.

On Tuesday, the Dow Jones index declined by 0.56%, equivalent to 196 points, marking its highest daily loss in a week. Similarly, the S&P 500 index dropped by 0.4%, shedding 4500 points at the close, while the Nasdaq Composite index dipped by approximately 0.1%, recording its second consecutive daily loss.

In contrast, Oracle’s stock surged by 2.5% during Tuesday’s session, reaching its highest level since June 15th of the previous year. This gain added $8.3 billion to the company’s market capitalization in a single day.

Pivot point: 34760

| Resistance level | Support level |

| 34850 | 34600 |

| 35005 | 34510 |

| 35095 | 34355 |

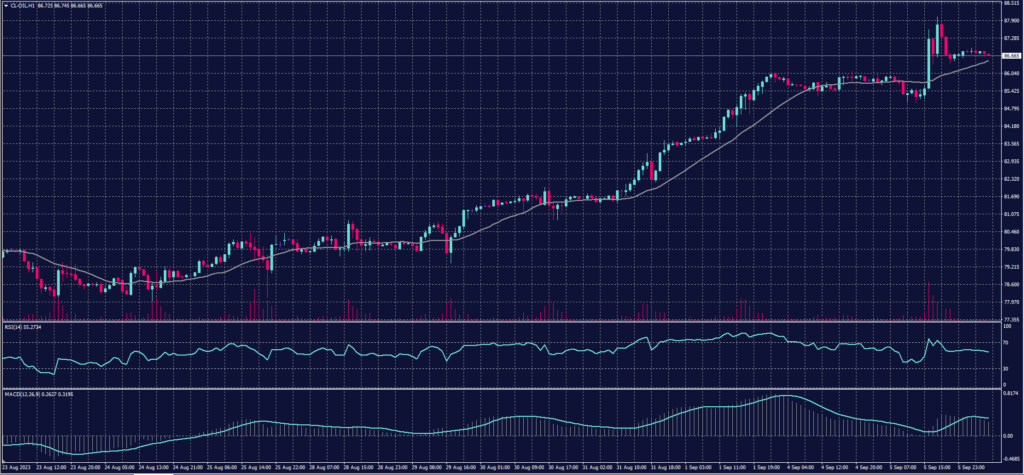

US Crude (USOUSD)

Oil prices rose by one dollar per barrel on Tuesday, reaching their highest levels since November. This surge came after Saudi Arabia and Russia announced a new extension of voluntary production cuts until the end of the year, raising concerns among investors about a potential supply shortage during the winter season when demand for oil increases.

Brent crude futures increased by 1.2%, or $1.04 per barrel, to settle at $90.04 per barrel. This marked the first time it had settled above $90 since November 16, 2022.

Similarly, West Texas Intermediate (WTI) crude oil futures rose by 1.3%, or $1.14 per barrel, to settle at $86.69 per barrel. This also represented their highest level in 10 months.

Pivot point: 86.55

| Resistance level | Support level |

| 88.15 | 85.10 |

| 89.60 | 83.55 |

| 91.15 | 82.10 |

Risk Warning

This material provides real-time market analysis from contributing analysts. Please note that any views expressed in this material do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this material.