Profit-Taking Operations Push Oil Prices Down

market news summary

European stocks recorded a slight decline at the close on Friday, but that did not prevent them from registering the largest weekly percentage gains in over three months amid hopes that the Federal Reserve’s inflation easing would soon allow it to stop raising interest rates.

The STOXX 600 index of European stocks closed down 0.1% on Friday after rising over five sessions. Oil and gas stocks fell 2.1% due to a decline in oil prices.

Bank of America said that risky assets, such as stocks, are becoming more attractive, with investors injecting more liquidity in recent days as inflation appears to be easing.

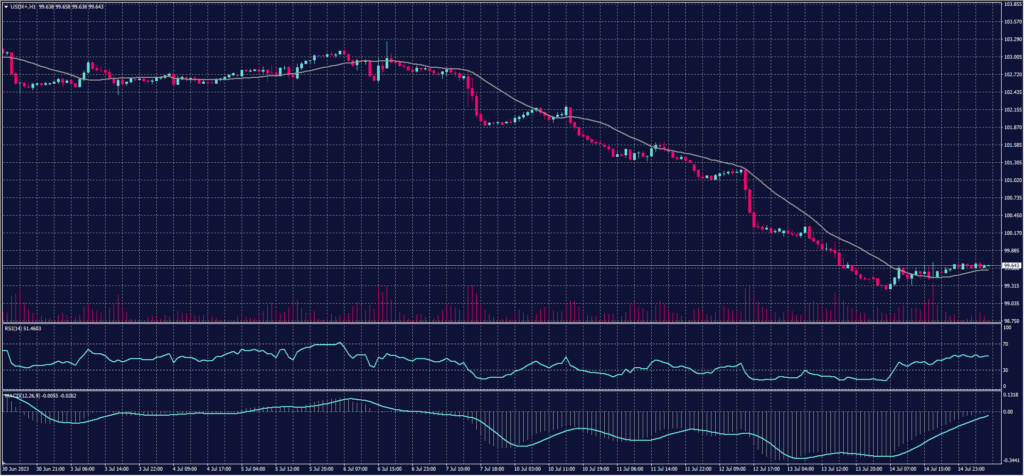

DOLLAR INDEX (USDX)

The US dollar witnessed a sharp decline during last week’s currency market trading, primarily driven by producer and consumer price inflation data in the United States, despite positive unemployment claims results.

The dollar index is still trading below the 100 level today.

Pivot point: 99.50

| Resistance level | Support level |

| 99.80 | 99.35 |

| 100.00 | 99.05 |

| 100.25 | 98.90 |

Spot Gold (XAUUSD)

Gold declined on Friday, July 14, but achieved its biggest weekly gain since April after signals of slowing inflation this week raised some hopes of a halt in US interest rate hikes.

Gold ended the trading session at $1955 per ounce but rose by 1.65% in its best week since April.

Pivot point: 1956

| Resistance level | Support level |

| 1962 | 1949 |

| 1969 | 1943 |

| 1975 | 1936 |

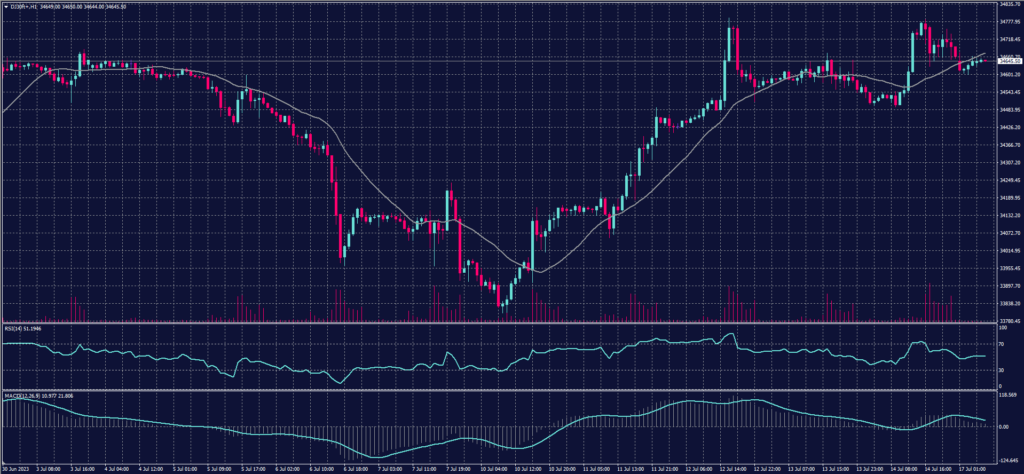

Dow Jones Index (DJ30ft – US30)

The Dow Jones Industrial Average rose at the close of trading on Friday as strong earnings results from some of the largest banks and companies kicked off the second-quarter earnings season, while both the S&P 500 and Nasdaq declined.

The Dow Jones added around 113.89 points or 0.33% to close at 34,509.03, marking the fifth consecutive day of gains.

Pivot point: 34645

| Resistance level | Support level |

| 34800 | 34510 |

| 34935 | 34355 |

| 35090 | 34215 |

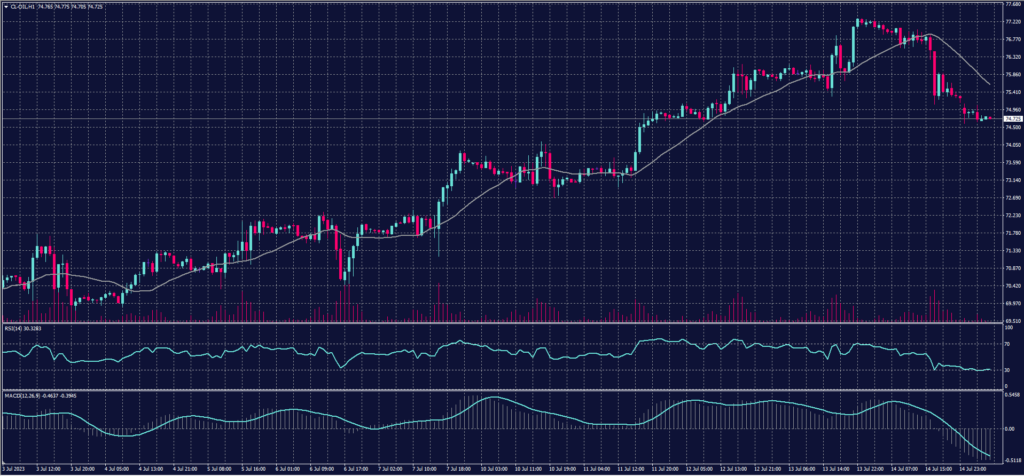

US Crude (USOUSD)

Oil prices fell over a dollar per barrel on Friday as the dollar strengthened and market participants in the oil market engaged in profit-taking after a significant rise in crude prices. However, both crudes recorded gains for the third consecutive week.

Brent crude futures dropped $1.49, or 1.8%, to settle at $79.87 per barrel, while West Texas Intermediate (WTI) crude futures declined by $1.47, or 1.9%, to reach $75.42 per barrel.

Pivot point: 75.85

| Resistance level | Support level |

| 76.65 | 74.45 |

| 78.05 | 73.70 |

| 78.80 | 72.30 |

Risk Warning

This material provides real-time market analysis from contributing analysts. Please note that any views expressed in this material do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this material.