The Bank of Canada Raised Interest Rates to the Highest Level in 22 Years

Market News Summary

On Wednesday, the Energy Information Administration reported that U.S. crude oil inventories unexpectedly declined last week, with refinery output exceeding the 2019 peak during the Memorial Day weekend. The crude oil refinery utilization rate increased by 482,000 barrels per day, while refinery runs rose by 2.7% over the week to the highest level since August 2019.

European stocks declined yesterday, influenced by a drop in healthcare stocks and concerns about interest rate expectations in the Eurozone. However, strong profits from Inditex, the owner of Zara, boosted gains in retail stocks and Spanish shares.

The Stoxx 600 index closed down 0.2%, and most financial markets in Europe saw declines, although the Spanish IBEX index closed up 0.5% at a six-week high.

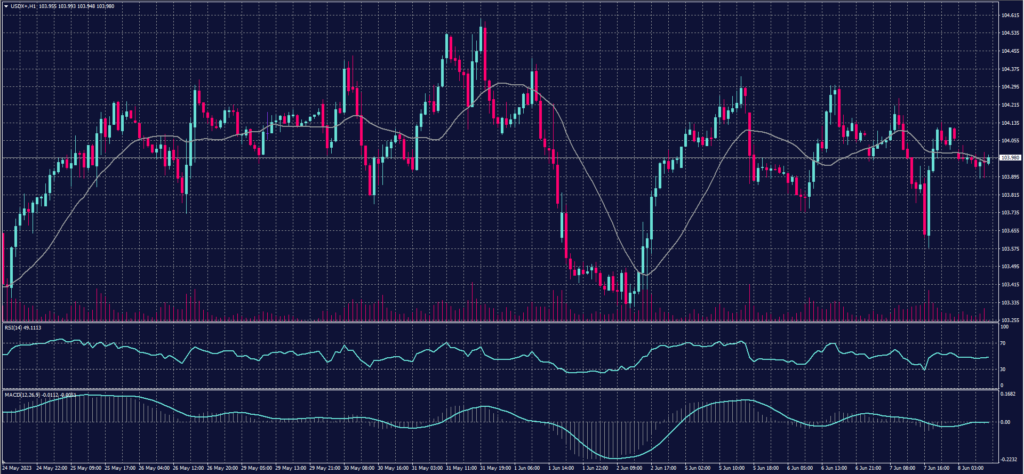

Dollar Index (USDX)

The dollar declined on Thursday, June 8th, despite receiving some support from rising U.S. Treasury bond yields, as traders assess the possibility of another interest rate hike by the Federal Reserve, even if it refrains from doing so next week.

The dollar index edged slightly lower to 104.02 but remained not far from a two-month high reached last week, supported by the rise in Treasury yields.

The yield on 10-year Treasury bonds reached 3.7914% after rising about 10 basis points and hitting a peak of 3.801% on Wednesday.

Pivot point: 103.95

| Resistance level | Support level |

| 104.35 | 103.70 |

| 104.65 | 103.30 |

| 105.00 | 103.00 |

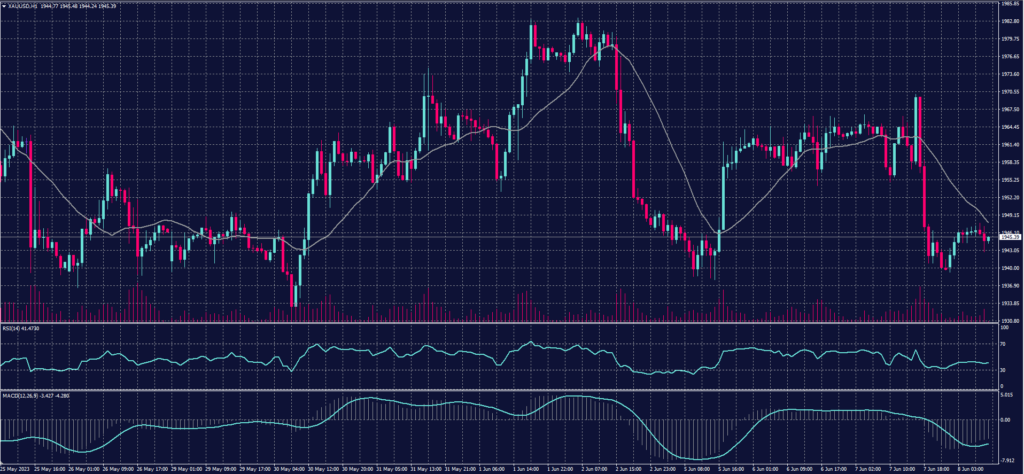

Spot Gold (XAUUSD)

Gold prices rose on Thursday, June 8th, supported by weakness in the dollar, but the yellow metal remained near the previous session’s low levels as investors awaited signals from the Federal Reserve after the Bank of Canada raised interest rates to the highest level in 22 years.

Spot gold increased by 0.4% to $1,946.47 per ounce after declining by 1% in the previous session. U.S. gold futures also rose by 0.1% to $1,961.00.

Pivot point: 1949

| Resistance level | Support level |

| 1960 | 1929 |

| 1980 | 1919 |

| 1990 | 1899 |

Dow Jones Index (DJ30ft – US30)

The US stock market closed mixed on Wednesday, with the Dow Jones index posting gains while the S&P 500 and Nasdaq Composite declined, weighed down by profit-taking after recent strong gains.

The Dow Jones index closed up approximately 0.3%, or around 90 points, on Wednesday, supported by a 2.7% rise in Goldman Sachs shares and a 2.6% increase in Chevron shares, which benefited from recent oil price hikes.

On the other hand, the S&P 500 index declined by about 0.4% after rising over 20% since the October 2022 low, while the Nasdaq Composite fell by about 1.3%, marking its largest daily losses in 6 weeks, after gaining more than 25% since the beginning of the current year.

Pivot point: 33660

| Resistance level | Support level |

| 33785 | 33580 |

| 33865 | 33455 |

| 33985 | 33375 |

US Crude (USOUSD)

There were no significant changes in oil prices in early Asian trading on Thursday, June 8th, as investors assessed concerns about demand amid a slowdown in the global economy against expected supply declines due to Saudi production cuts.

Brent crude futures declined by one cent to $76.94 per barrel, while West Texas Intermediate (WTI) crude futures rose by five cents to $72.58 per barrel.

Pivot point: 72.20

| Resistance level | Support level |

| 73.40 | 71.20 |

| 74.35 | 70.00 |

| 75.55 | 69.05 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.