The Dollar Continues to Rise, and Energy Prices Are Falling

Market News Summary

European Central Bank Vice President Luis de Guindos rejected the talking about lowering interest rates in the Eurozone, considering it premature. He warned of challenges that may arise in the final stage of efforts to bring inflation down to the targeted range of 2% annually in the medium term.

Wall Street faces rising bond yields, with the yield on 10-year Treasury bonds surpassing 4.7% at one point on Monday, marking its highest level since October 2007. Investors hope to turn the page on a disappointing September for stocks. All three major indices closed lower in September, with the S&P 500 losing nearly 5% in the month.

Dollar Index (USDX)

The dollar index rose on Monday, extending its gains for the fourth consecutive week. This came after the U.S. government avoided a partial shutdown, and economic data bolstered expectations that the Federal Reserve would keep interest rates higher for a longer period.

The dollar index increased by 0.62% to 106.89, while the euro fell by 0.7% to $1.0491.

Pivot Point: 105.25

| Resistance level | Support level |

| 107.05 | 106.05 |

| 107.40 | 105.40 |

| 108.00 | 104.80 |

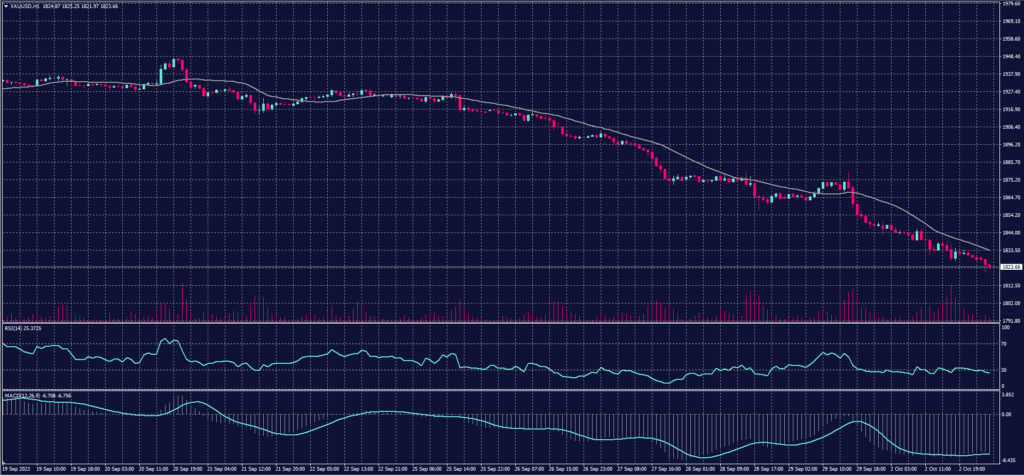

Spot Gold (XAUUSD)

Gold continued its decline for the sixth consecutive session on Monday, reaching its lowest levels in about seven months. This was driven by the rise of the dollar and expectations of higher U.S. interest rates, which dimmed the allure of gold.

The spot price of gold fell by 0.9% to $1,831.70 per ounce, marking its lowest level since early March. U.S. gold futures settled down 1% at $1,847.20 per ounce.

Pivot Point: 1835

| Resistance level | Support level |

| 1843 | 1819 |

| 1858 | 1811 |

| 1866 | 1796 |

Dow Jones Index (DJ30ft – US30)

U.S. indices closed with mixed results on Monday as investors assessed the possibility that the Federal Reserve may need to keep interest rates higher for an extended period. Federal Reserve Governor Michelle Bowman stated that she remains prepared to support another interest rate hike in future meetings if upcoming data indicates that the decline in inflation has halted or is proceeding extremely slowly.

The Dow Jones Industrial Average declined by 0.22%, equivalent to approximately 74 points, in Monday’s session, marking its lowest closing in four months, despite recovering most of its losses before the closing.

Pivot point: 33665

| Resistance level | Support level |

| 33905 | 33400 |

| 34170 | 33165 |

| 34405 | 32900 |

US Crude Oil (USOUSD)

Oil prices fell by approximately 2% on Monday, reaching their lowest level in three weeks. This decline was attributed to the strength of the U.S. dollar and profit-taking by traders amid concerns about increased crude oil supplies and pressure on demand due to rising interest rates.

Brent crude futures for December settlement dropped by $1.49 or approximately 1.6% to $90.71 per barrel at the close, while West Texas Intermediate (WTI) crude futures settled down $1.97 or 2.2% to $88.82 per barrel.

Pivot point: 89.65

| Resistance level | Support level |

| 90.85 | 87.40 |

| 93.05 | 86.25 |

| 94.25 | 84.00 |

Risk Warning

This article provides real-time market analysis from contributing analysts. Please note that any views expressed in this article do not constitute operational advice. It is important to assess your risk tolerance and make independent trading decisions. STARTRADER holds no responsibility for any trading consequences that may arise from relying on the views expressed in this article.