The Greenback Is Weak And Markets Await CPI Data

U.S. Dollar Index (USDX)

The U.S. dollar remains weak, although it edged higher during the Asian session. The Greenback stabilizing ahead of the key inflation data later today. Crucial U.S. consumer inflation data is expected to show the annual CPI figure falling to 8.0% in October from 8.2% the prior month, while the core figure, which excludes volatile food and energy prices, is seen dropping to an annual 6.5%, from 6.6%.

The dollar has been under downward pressure of late from expectations that the Federal Reserve will ease back from its aggressive hiking cycle shortly, potentially as early as December.

The dollar index broke below the support and neckline at 109.90 reaching 109.40. However, breaking the resistance between 109.40 and 109.20 will most likely lead to a drop toward 107.50 on the daily chart. Technical indicators also show selling pressure while MACD specifically is showing convergence and further decline.

Pivot Point: 110.35

| SUPPORT | RESISTANCE |

| 109.40 | 110.70 |

| 108.80 | 111.10 |

| 108.10 | 111.60 |

Euro (EURUSD)

Euro pair fell 0.1% to 1.0050, with the European Central Bank holding a non-policy setting meeting in the previous session. ECB policymakers have made it clear that further rate hikes are on the way after the central bank lifted interest rates by 75 basis points late last month even as growth in the Eurozone suffers.

On the other hand, the hourly chart shows a possibility of fluctuations below the level of 1.0100 while technical indicators signal a decline. However, the pair is seen breaking below the parity levels.

Pivot Point: 1.0050

| SUPPORT | RESISTANCE |

| 0.9990 | 1.0100 |

| 0.9920 | 1.0150 |

| 0.9870 | 1.0190 |

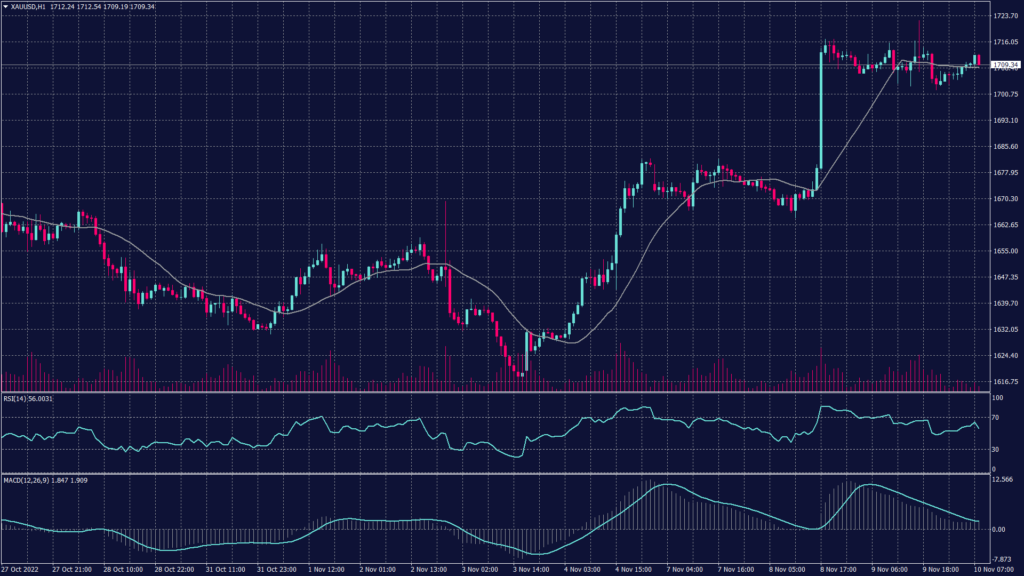

Spot Gold (XAUUSD)

Gold prices remained pinned near a one-month high amid uncertainty over the U.S. midterm elections and as markets awaited key inflation data from the country later in the day.

Bullion prices logged strong gains this week as the dollar retreated in the run-up to the elections. Initial results show that the Republicans were still favored to win both houses of Congress, although Democrats performed better than expected. Spot gold fell slightly to $1,705 an ounce, while gold futures were largely unchanged at $1,709 an ounce.

The hourly chart shows a horizontal movement between the levels of 1,705 and 1,715 above the steep 20 candles moving average. Technical indicators show a possible decline as RSI is at 70 and MACD shows divergence with a possibility of decline.

Pivot Point: 1,710

| SUPPORT | RESISTANCE |

| 1,705 | 1,715 |

| 1,685 | 1,725 |

| 1,675 | 1,735 |

West Texas Crude (USOUSD)

Oil prices fell further on Thursday amid growing concerns over a slowdown in global economic growth, with the focus now turning to upcoming U.S. inflation data that is expected to set the tone for monetary policy in the coming months.

Crude prices fell sharply this week as data showed U.S. crude oil inventories grew thrice as much as expected in the past week, although a bulk of this was driven by a roughly 3.5 million barrels draw down from the Strategic Petroleum Reserve (SPR). Investors are now uncertain over future drawdowns from the SPR, given that the reserve is currently at 40-year lows, and that the U.S. midterm elections were seen as a major driver of the move.

WTI declines to 87.50 which is considered major support, breaking this level might lead to a drop towards 84.85 on the hourly chart and 76.10 on the daily chart. However, technical indicators on both time frames show resilience with a probability of a rebound.

Pivot Point: 84.65

| SUPPORT | RESISTANCE |

| 83.60 | 85.50 |

| 83.40 | 86.35 |

| 81.00 | 87.00 |